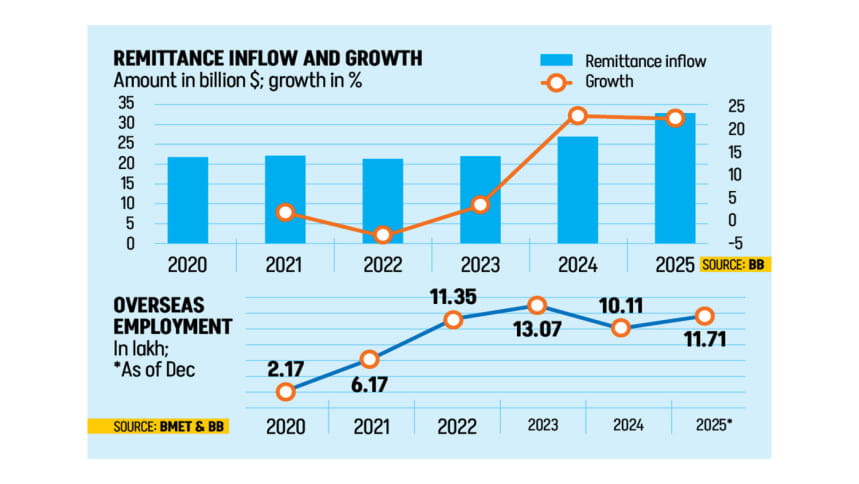

Bangladesh closed 2025 with a landmark achievement as remittance inflows reached $32.81 billion, the highest ever recorded in the country’s history. The surge has emerged as a critical stabilising force for the economy, strengthening foreign exchange reserves and restoring confidence in the financial system after years of external pressure.

Data from Bangladesh Bank shows remittance earnings rose 22 percent compared to 2024, marking the first time annual inflows exceeded the $30 billion threshold. Economists say the increase reflects a structural shift, with expatriates increasingly choosing formal banking channels over informal networks.

A Shift That Began After Political Change

The upward trend gained momentum after the political transition in August 2024. Since then, tighter monitoring, legal reforms, and stricter action against illegal money transfers have reduced the influence of hundi networks. As confidence returned, expatriates responded by sending more money through regulated channels.

Unlike previous years, the rise was not limited to seasonal periods around Eid. Remittances remained consistently strong throughout 2025, indicating a lasting change in behaviour rather than a temporary spike.

December and March Set New Benchmarks

In December 2025, remittances reached $3.23 billion, the second-highest monthly inflow on record. The peak came earlier in March, when inflows touched $3.30 billion, supported by Ramadan and Eid-related transfers.

These sustained inflows helped push Bangladesh’s foreign exchange reserves above $33 billion, easing dollar shortages and reducing volatility in the exchange rate.

Decline in Hundi Strengthens Formal Flows

Dr Zahid Hussain, former lead economist at the World Bank, has linked the remittance surge to a decline in money laundering and capital flight. He noted that as illicit channels narrowed, demand for hundi weakened, naturally redirecting funds into the banking system.

Analysts also point to government incentives, including a 2.5 percent cash benefit on remittances, as an additional factor encouraging legal transfers.

Stabilising the Dollar Market

The record inflows have had a visible impact on the broader economy. Since late 2024, the interbank exchange rate has stabilised around Tk122 per US dollar, improving access to foreign currency. Inflation, which had remained stubbornly high, eased to 8.29 percent by November 2025.

With remittance inflows exceeding demand for dollars, Bangladesh Bank has stepped in to purchase foreign currency from commercial banks. In the first half of the current fiscal year alone, the central bank bought more than $3 billion, reinforcing reserve buffers.

Why This Milestone Matters

Economists say the $32.8 billion remittance milestone is more than a headline figure. It reflects renewed trust among expatriates, improved governance in the financial sector, and a clearer path toward external stability.

If current trends continue, policymakers believe remittances could exceed $35 billion in the next fiscal year, offering Bangladesh a stronger foundation to manage imports, service foreign debt, and support economic recovery.